Introduction to the top cryptocurrency

Bitcoin (BTC) is a cryptocurrency or virtual currency.

It functions as money by design and a form of payment independent of any person, group, or entity.

This digital asset, however, is slowly becoming regarded primarily as a store of value instead of a payment solution.

Bitcoin does away with the need for third-party involvement in financial transactions.

Satoshi Nakamoto, a pseudonym for an unidentified developer or group of developers, introduced Bitcoin to the world in 2009 through a whitepaper.

It has since become the world’s most well-known cryptocurrency.

BTC’s popularity has resulted in thousands of other cryptocurrencies or altcoins.

Early rivals have tried to replace it as a payment method though BTC remains the king of cryptocurrencies.

Altcoins, however, also serve other functions, such as but not limited to:

- Stablecoins

- Utility

- Privacy

- Central Bank Digital Currencies (CBDCs)

- Non-Fungible Tokens (NFTs)

- Governance Tokens

Bitcoin’s Origins

It was August 2008 when Bitcoin.org was registered.

No record exists, however, of the identity of the person that registered the domain.

It is not publicly available and is WhoisGuard Protected.

Satoshi then posted an announcement on metzdowd.com’s Cryptography Mailing List two months after.

It proclaimed ongoing work on a new electronic cash system, which was fully peer-to-peer, without a trusted third party.

The famous white paper, “Bitcoin: A Peer-to-Peer Electronic Cash System,” was then published on Bitcoin.org dated October 31, 2008.

Block 0 mined on January 3, 2009, was the first Bitcoin block.

It is known as the “genesis block” and contains text regarding banks on the brink of a second bailout.

Possibly, it was to provide evidence of mining on such a date since these events were transpiring around that time.

Bitcoin basics

The decentralized nature of the Proof-of-work (PoW) consensus algorithm secures Bitcoin and its ledger.

It is a system to confirm transactions and add new blocks to a blockchain network.

The process works by requiring miners to solve complex mathematical puzzles or computations. It uses a lot of computational power and energy in the form of electricity.

This “mining” process introduces new Bitcoin into the network through block rewards.

There will only be 21,000,000 Bitcoin in existence, no more, no less.

One Bitcoin can divide into eight decimal places. The smallest unit is known as a satoshi.

Modification to Bitcoin is possible only through the agreement of participating miners. More decimal places can be added, for example.

Mining corresponds to rewards in BTC, though the amounts change every four years after the Bitcoin “halving” takes place.

BTC mining rewards reduce by half for every 210,000 blocks following each “halving” event.

In 2009, for example, the block reward was 50 new Bitcoin.

The third halving occurred on May 11, 2020, with rewards reduced to 6.25 Bitcoin for each block discovery.

This block reward system will continue until 2140. It is the projected year when mining stops, completing all 21,000,000 Bitcoin.

To illustrate the rewards:

- 2009: 50 BTC

- 2012: 25 BTC

- 2016: 12.5 BTC

- 2020: 6.25 BTC

- 2024: 3.125 BTC

- 2028: 1.5625 BTC, and so on

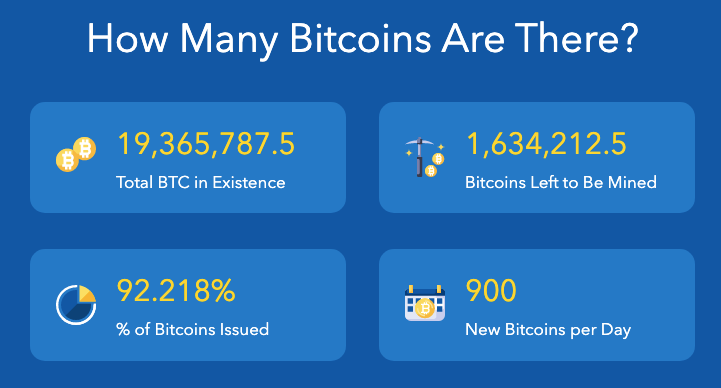

As of May 6, 2023, there were 19,365,787.5 Bitcoin in circulation and 1,634,212.5 Bitcoin left to mine.

It results in 92.218% of Bitcoin issued and 900 BTC per day.

If you want to know the current number of Bitcoin, visit buybitcoinworldwide.com.

Proof-of-Work, briefly

Blockchain miners can receive Bitcoin in exchange for their efforts in verifying transactions.

They maintain the blockchain by performing a series of complex computations under the Proof-of-Work consensus protocol or mining.

Bitcoin utilizes a hashing algorithm called SHA-256.

It encrypts transaction data in each block onto its blockchain into a 256-bit hexadecimal number.

Think of it as replicating information from previous blocks onto new blocks. The next block will also contain new encrypted data from current transactions.

These transactions are verified by miners, also known as network validators. New blocks open whenever miners verify transactions.

It is here where block discovery takes place.

New Bitcoin is then “mined” as rewards to miners working to verify the data.

Queued blockchain transactions only go through after receiving validation from miners. To do this, they simultaneously try to solve a four-byte number called a nonce.

Miners now use special mining equipment in the form of computer hardware and software to solve this nonce found in each block header.

They continually hash such block headers until they meet the required number of times by the blockchain as “solved”, creating a new block.

These blocks store data from succeeding transactions for encryption and verification.

Hashing is a way to convert data, like text or numbers, into a fixed-size string of characters called a “hash”. It is used to represent the original data compactly and securely.

Expect a more in-depth article on Bitcoin’s Proof-of-Work consensus algorithm in the future. For now, let us focus on its overview.

Hash power

The use of a variety of devices and software is possible to mine BTC.

Initially, it was possible to mine it competitively on a personal computer.

As the network grew in popularity, more miners joined, lowering the chances of being the one to solve the hash.

You can still mine with your personal computer if it has updated hardware. Your odds of solving a hash individually, however, are slim.

The reason?

You are competing with a network of miners that create around 220 quintillion hashes (220 exa hashes) each second.

Machines designed exclusively for mining, called Application Specific Integrated Circuits (ASICs), perform approximately 255 trillion hashes per second.

By comparison, a computer with the most recent hardware only hashes roughly 100 mega hashes per second (100 million).

Mining BTC as a business

The Bitcoin network rewards miners when they validate blocks and receive compensation for their efforts.

They come in the form of Bitcoin from block rewards or transaction fees.

These Bitcoin are exchanged for fiat currency through cryptocurrency exchanges or used to make purchases from merchants and retailers who accept them.

Buying and selling BTC can be profitable for investors and speculators.

The mining network validates a block and generates the reward in about 10 minutes on average.

As mentioned earlier, the compensation for each block is currently at 6.25 BTC. It takes around 100 seconds to mine 1 BTC.

You have various alternatives to succeed as a Bitcoin miner.

Utilize your existing computer to run Bitcoin-compatible mining software and join a mining pool.

Mining pools are groups of miners who pool their computing power to compete against massive ASIC mining farms.

You could also invest in an ASIC miner if you have the funds. A new unit can easily cost thousands of dollars.

Used ones are also sold by miners when they improve their systems. If you buy one or more ASICs, you must factor in substantial expenditures such as electricity and cooling.

Many mining programs are available with numerous pools to join. CGMiner and BFGMiner are two of the most well-known apps.

Make sure to investigate how they distribute prizes when selecting a mining pool. Check what fees may apply and read some mining pool reviews.

In conclusion

Bitcoin as a type of digital cash is not overly complex to grasp.

If you hold Bitcoin, you can use your cryptocurrency wallet to send smaller amounts of BTC as payment for goods or services.

It becomes extremely complicated, however, when you try to figure out how it works.

To illustrate, do you need to know how the mechanical parts of an airplane work together before getting on board?

Leave a Reply