XRP began with its three founders in 2011: David Schwartz, Jeb McCaleb and Arthur Britto. They initially developed the XRP Ledger (XRPL) and launched it in June of 2012.

XRP would become the native currency on XRPL. The group then established a company called NewCoin which was eventually named Ripple as we know it today.

A Bit Of Background

Unlike Bitcoin which had to be mined to produce its 21 million tokens, XRP’s 100 billion tokens were pre-mined. This was established from the very beginning.

A total of 80 billion was set aside for the general public. Twenty billion XRP were allocated to its team.

As of April 2023, around 51 billion XRP is in circulation. About 42 billion XRP is yet to be released from escrow by Ripple.

All right, now let’s discuss some pros and cons of this consistently high ranking crypto project.

Pros of XRP

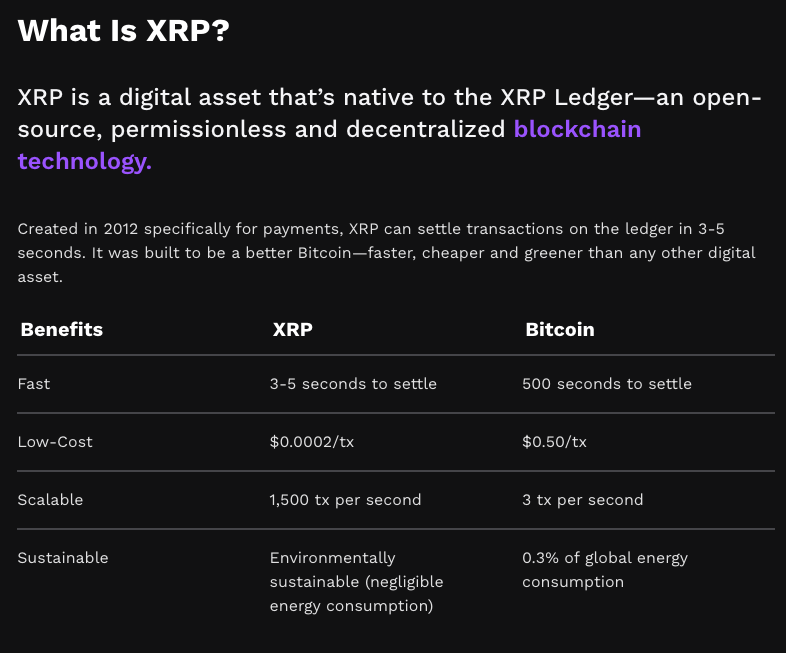

1. Fast transaction speeds

One of XRP’s key features is its quick transaction speeds. The XRP Ledger is one of the fastest blockchain-based payment networks, processing transactions in as low as four seconds.

This is due in part to the fact that, unlike Bitcoin and other cryptocurrencies, XRP does not rely on mining. XRP transactions, on the other hand, are approved using a consensus algorithm.

This method takes less computer resources and results in faster transaction speeds.

XRP can handle a large number of transactions at the same time. This makes it a viable option for large-scale payment processing.

It’s especially appealing to financial firms trying to improve the speed and efficiency of their cross-border payment processing.

The high transaction speeds of XRP have been demonstrated in a variety of real-world use scenarios.

In 2018, Santander, one of the world’s major banks, unveiled One Pay FX. This is a mobile app that leverages XRP to facilitate rapid cross-border payments between the United Kingdom and Spain.

Customers may use the app to send and receive payments in seconds, which is substantially faster than traditional payment methods.

2. Low fees

Another benefit of XRP is that it has negligible transaction fees. They are much lower than those associated with traditional payment methods.

Bank wire transfers can be costly and time-consuming.

Fees for XRP transactions are typically a fraction of a penny. They are calculated based on the amount of XRP transmitted.

In contrast, Bitcoin has been known to have higher transaction fees especially during times of great demand.

The efficient payment mechanism is one of the reasons for XRP’s low transaction fees (0.0001 XRP as fees). Unlike other cryptocurrencies, XRP was created with payment processing in mind, with an emphasis on speed, efficiency, and cost-effectiveness.

Furthermore, XRP’s low transaction fees make it an appealing option for micropayments, or small-value transactions.

High fees are involved with traditional bank wire transfers. They are difficult to process using regular payment methods.

XRP’s low fees, on the other hand, make it a feasible alternative for micropayments.

3. Scalability

XRP’s unique payment protocol, the XRP Ledger, makes it highly scalable. The XRP Ledger was built to handle a large number of transactions at once.

Its consensus algorithm is known as the Ripple Protocol Consensus Algorithm (RPCA). This is a lightweight consensus method. It’s designed to allow for quick transaction processing.

This occurs without the significant computational power required by mining-based techniques.

This is one of the ways it accomplishes scalability and makes it a scalable solution for payment processing.

Furthermore, the XRP Ledger can process up to 1,500 transactions per second. It’s one of the world’s fastest payment networks.

In comparison, Bitcoin has a transaction processing limit of about seven transactions per second.

XRP’s scalability makes it appealing to financial institutions. Payment providers must process large volumes of transactions quickly and efficiently.

Because of its scalability, XRP is also well-suited for micropayments.

These involve small transaction amounts and necessitate a high volume of transactions. These transactions need to be completed swiftly and effectively.

Cons of XRP

1. Concerns over centralization

A hotbed for debate is whether or not XRP is truly a decentralized token. Anyone can visit xrpl.org and read about the relationship between Ripple and XRP:

“Ripple is a technology company that makes it easier to build a high-performance, global payments business. XRP is a digital asset independent of this.”

xrpl.org

While true, Ripple itself is the custodian of over 42 billion XRP currently locked in escrow. It’s responsible for releasing 1 billion XRP into the market on the first of every month.

It should have been capable of releasing around 63 billion XRP by now.

In spite of this, Ripple still controls 42 billion XRP because any unused unlocked tokens are returned to escrow.

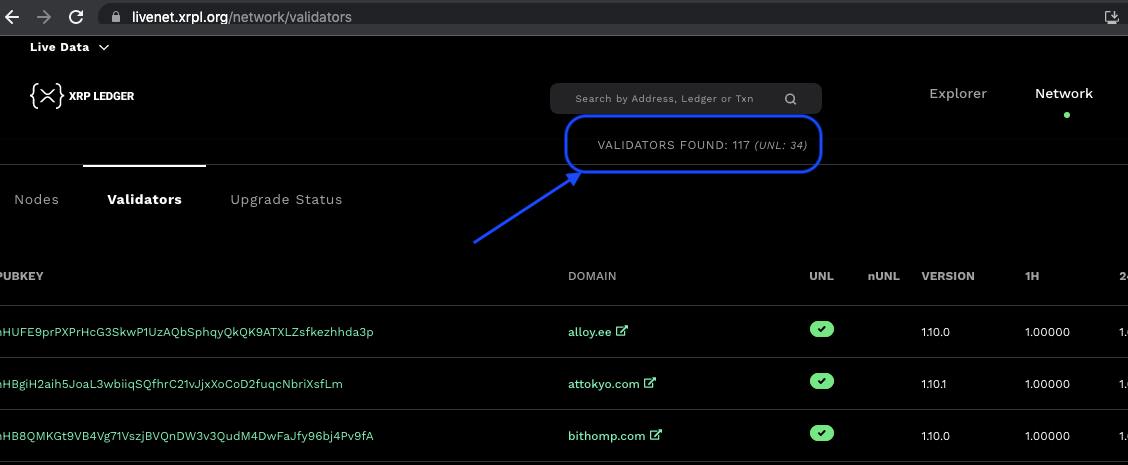

There is also concern over Ripple potentially having control over XRPL’s quorum based consensus protocol, the RCPA.

This requires a consensus of 80% from validator nodes within a Unique Node List (UNL). A consensus must be reached before a transaction is confirmed and recorded unto the XRP ledger.

There are currently 117 validators.

They can select other validators to occupy the allocated 34 validator node slots. These slots constitute a Unique Node List (UNL).

UNLs are essentially lists of validators. A particular participant trusts these validators will not collude and conspire against them in a fraudulent manner.

The point of contention lies in the default UNL (dUNL) which is commonly used to run the RCPA.

It’s currently Ripple and the XRPL foundation which publishes such dUNL’s for the RCPA to function.

There were previously six Ripple owned validators in the dUNL. This was then reduced to two.

There could possibly be only one remaining at the moment.

It should be noted that Ripple gives financial incentives to many of the existing validators (server operators). These instances create skepticism over the company’s influence over XRPL.

Nevertheless, it should be noted that validators are free to create their own UNL.

2. Regulatory uncertainty

For some years, the US Securities and Exchange Commission (SEC) has been examining XRP and its parent company, Ripple Labs.

The SEC sued Ripple Labs in December 2020. They stated that XRP was an unregistered security. They also claimed that Ripple had participated in an unregistered securities offering for $1.3 billion.

The lawsuit created tremendous uncertainty for XRP investors, causing the price of XRP to plummet dramatically.

XRP was also delisted by several major cryptocurrency exchanges like Coinbase, citing regulatory issues.

The litigation is still underway, and the conclusion might have far-reaching consequences for the cryptocurrency industry as a whole.

If the SEC wins and XRP is declared a security, other cryptocurrencies may be categorized as securities.

They may also be subject to increased regulatory scrutiny.

Conclusion

To summarize, XRP has both advantages and disadvantages, and whether it is a suitable investment depends on your own circumstances.

Its quick transaction speeds, minimal transaction fees, and scalability are important benefits. However, concerns about centralization and regulatory uncertainty are possible drawbacks.

Keep in mind that XRP the token is a separate entity from Ripple’s ecosystem of products.

Before making any investing decisions, it is critical to conduct research and talk with a financial expert.

The cryptocurrency market is extremely volatile, and values can change very quickly.

Leave a Reply to Crypto Regulation: Role Of SEC Crypto And CFTC Crypto In The Industry – GM Cryptoverse Cancel reply